MONTHLY BLOGS

The True Cost of Homeownership: What You Pay Beyond the Mortgage [Feb 2026]

When many new homebuyers calculate whether they can afford a new home, they focus almost exclusively on one number: the monthly mortgage payment. It's the figure lenders use for the mortgage stress test, the number real estate agents discuss during showings, and the benchmark buyers use to determine their budget.

However, the mortgage is only the starting line. Homeowners also pay for property taxes, insurance, utilities, maintenance fees, surprise repairs and ongoing maintenance. According to housing cost breakdowns from Ratehub, these non-mortgage expenses can easily add $1,500 or more per month on top of the mortgage, depending on the home and location. When you factor in these costs, a $3,000 monthly mortgage can quickly push total housing expenses well beyond $4,500 per month.¹

So while qualifying for a mortgage answers one question, "Can a bank trust you with this loan?", it doesn't answer the more important one: "Can you comfortably maintain this lifestyle?"

In today’s market, about one in four Canadian homebuyers report experiencing at least some post-purchase regret.² While most homeowners remain satisfied, research shows that regret often emerges when the true cost of ownership, such as maintenance, repairs, and ongoing living expenses was higher than expected. To reduce the risk of buyer’s remorse, it’s critical for homebuyers to plan not just for the mortgage payment, but for the full cost of living in the home.

The Predictable Ongoing Costs

Property Taxes

Property tax bills have been rising in many cities as municipalities work to fund infrastructure and services. In 2024, the median year-over-year change in property tax rates among 24 major Canadian cities was about 4.9 percent, with some regions experiencing even greater increases.³Property taxes aren’t fixed. Reassessments and rate changes happen regularly, and as neighbourhood values rise, so do tax bills even when the rate stays the same.

Home Insurance

As of 2026, home insurance premiums have entered a “new normal.” Record weather-related losses in 2024, combined with higher rebuilding and replacement costs, continue to push insurers to raise rates and reassess risk across many regions.⁴In provinces like Alberta, home insurance premiums have increased by nearly 90% over the past decade, with similar upward pressure emerging nationwide.⁵ As insurers recalibrate risk at the postal code level, homeowners can see their premiums rise $100–$200 per month in a single year, even without making a claim or changing coverage.

Condo Maintenance Fees

For buyers entering the condo market, monthly fees typically range from $0.60 to $1.00 per square foot, depending on the building and amenities.⁶ These fees are mandatory and are used to fund day-to-day operations as well as long-term reserve funds for major repairs.Unlike the US where HOA fees are often optional community amenities, Canadian condo fees are mandatory contributions that prevent catastrophic special assessments later.

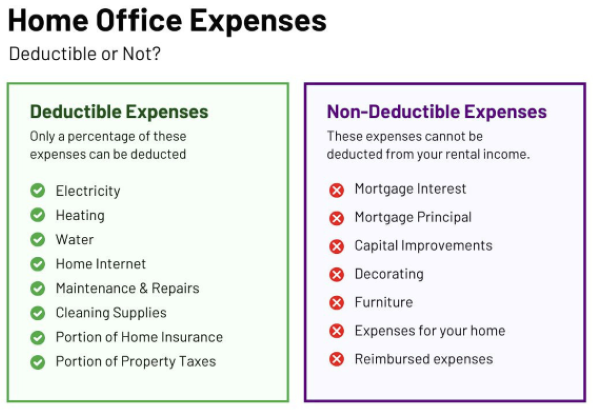

Utilities

Homeowners should budget between $250 to $600 monthly for utilities including electricity, heating, water, internet, and phone services, with costs varying based on your home's size and location.1These expenses often come as a surprise to first-time buyers, particularly those transitioning from apartment living where some utilities may have been included in rent. Larger homes naturally require more energy for heating and cooling, while properties with outdoor spaces may see higher water usage during warmer months.

The "Commuter Tax"

There's also what might be called "the commuter tax." Moving to suburban markets for a cheaper house can increase gas and transit costs that often negate the mortgage savings. That $300,000 price difference disappears quickly if you're spending an extra $400 monthly on various Transits, gas and/or Highway 407.Routine Maintenance

Beyond emergencies, Canadian homes require ongoing care: lawn service, gutter cleaning, pest control, HVAC servicing, snow removal, and seasonal tasks. These aren't luxuries for many households they're practical solutions to time constraints and property upkeep in Canada's demanding climate. Collectively, these services can add $200-400 monthly to ownership costs.The Irregular, but Inevitable Expenses

Major System Replacements

This is where many Canadian homeowners get caught off guard. Maintenance and repairs aren’t a matter of if but when and rising labour and material costs have made these repairs significantly more expensive in recent years.According to Statistics Canada and industry cost reports, home repair and maintenance costs have increased materially since 2018, driven by construction inflation and labour shortages.7 As a result, homeowners are commonly advised to budget 1% to 2% of their home’s value annually for maintenance and long-term repairs.8

Major system replacements can add up quickly:

- Roof replacement: $8,000–$15,000+9

- HVAC (furnace or heat pump): $5,000–$12,00010

- Water heater: $1,200–$2,50011

- Foundation repairs: $4,000–$15,000+12

Use the inspection as a planning tool. A 15-year old furnace or aging roof signals $8,000-15,000 in likely expenses within the first few years. That's not a deal-breaker, it's a budget roadmap. Buyers who understand these timelines can plan strategically instead of scrambling when systems fail.

Canada's climate makes this worse. The "freeze-thaw" cycle can hurt some roofs, driveways, and foundations faster than most international climates. A roof that might last 25 years in Arizona may need replacement after 15-18 years in some provinces.

Newer isn't maintenance-free. Newer builds offer a temporary reprieve, but systems still age, warranties expire, and eventually every home requires major capital improvements.

Emergency repairs happen at the worst times. An HVAC failure during a cold snap, a burst pipe in winter, or ice dam damage to the roof, these scenarios happen when it's least convenient and most expensive. Without liquid reserves, a single emergency can derail finances entirely.

Ownership Costs That Creep Up Over Time

Here's what surprises many first-time buyers: the so-called "fixed costs" of homeownership aren't actually fixed.While a locked-rate mortgage provides payment stability for your term (typically 5 years), the other components, taxes, insurance, and condo fees can climb significantly year over year due to inflation, climate risk, and local policy changes. A mortgage payment that felt comfortable at closing can feel tight three years later, even without lifestyle changes.

The "2026 Renewal Wall" presents a significant challenge for homeowners. Large % of outstanding mortgages were and are expected to renew in 2025 or 2026, with many owners facing substantial payment increases.13 Unexpected costs go beyond just maintenance and repairs. Many homeowners will experience sticker shock when their mortgage payments reset at higher rates upon renewal.

The same gradual creep affects utilities, maintenance services, and every other aspect of homeownership.

Planning Smarter: How Canadian Homeowners Can Stay Ahead

The encouraging news: buyer's remorse is largely preventable. The issue isn't buying the wrong house, it's buying without adequate financial preparation for what homeownership entails.Create a Dedicated House Repair Fund

Separate from emergency savings, this fund exists solely for home maintenance and repairs. Treat it like a non-negotiable monthly bill, set up automatic transfers so it happens without thinking about it.The old rule of saving 1% of your home's value annually for repairs? It's proving insufficient for some homeowners, particularly those with older properties or homes experiencing extreme weather. Aim for 2% if possible. For a newer home with recent updates, less might suffice. For an older property or one with systems nearing end-of-life, you’ll likely need to plan for greater costs.

Don't Drain Your Savings at Closing

Cash reserves protect against surprises and prevent forced debt when repairs arise. If possible, keep a liquid emergency repair fund after closing rather than putting every available dollar into the down payment or immediate renovations. That breathing room matters more than most buyers realize.Invest in Preventative Maintenance

Annual furnace servicing, gutter cleaning, and seasonal inspections catch small problems before they become expensive emergencies. A modest service call that prevents a major system failure is always worthwhile.Create a seasonal maintenance calendar: HVAC checkups in spring and fall, gutter cleaning before winter, roof inspections after major storms. Consistency prevents costly surprises.

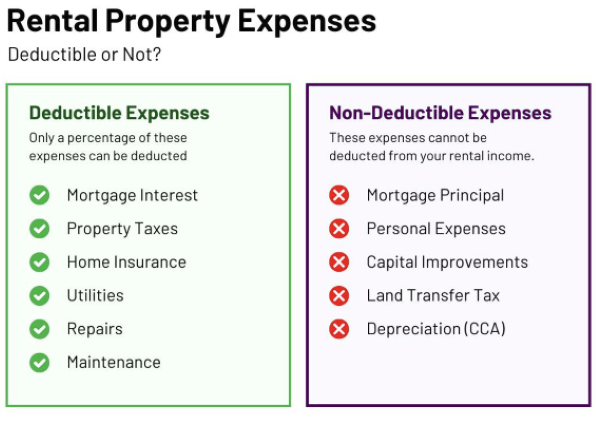

Leverage Canadian Tax Advantages

Consider leveraging Canadian tax advantages to build these reserves. First-time buyers should keep their FHSA (First Home Savings Account) open after purchase, or use the tax refund generated by it to seed their repair fund. The tax benefits you received while saving for the down payment can continue working for you as a homeowner.Know Your Home's Systems and Timelines

Understanding when major systems were last replaced helps predict future expenses. A 15-year-old water heater isn't an emergency today, but it signals a likely expense within the first few years of ownership. Planning beats scrambling.Why Homeownership Still Makes Sense

Despite the expenses, homeownership remains one of the most powerful wealth-building tools available to families when approached correctly.Long-Term Equity Building

Mortgage payments build equity with every payment. Unlike rent, ownership creates a forced savings mechanism that compounds over decades. In most markets, homes appreciate over time, multiplying the wealth-building effect.

Stability and Control

Homeowners control their living environment. Want to renovate the kitchen, paint the walls, landscape the yard, or install solar panels? Ownership provides autonomy that renting never will. That control has both lifestyle and financial value.Predictability vs. Rent Volatility

While ownership costs rise gradually over time, rent increases can be sudden and dramatic. A fixed-rate mortgage provides a level of predictability that the rental market cannot match.Yes, taxes and insurance increase, but the principal and interest portion typically 60-70% of the total payment remains locked for your term. Renters face volatility on 100% of their housing costs.

Lifestyle Benefits

Beyond finances, homeownership offers intangible benefits: deeper community roots, stability for families, space for hobbies, and the pride of building something that's truly yours. These benefits have real value, even if they don't appear on a balance sheet.The key is ensuring the financial foundation supports the lifestyle, not undermines it.

A Better Way to Think About Affordability

The true measure of affordability isn't what a lender will approve, it's what allows you to sleep well at night when the furnace fails or your mortgage comes up for renewal.The smartest buyers calculate affordability as "mortgage plus carrying costs" from the start. This might narrow the price range slightly, but it creates breathing room and peace of mind that makes a house feel like a home.

Homeownership remains one of the most powerful wealth-building tools available to families, but only when approached with financial realism rather than maximum leverage. Having an honest conversation about what affordability truly looks like isn't about limiting dreams, it's about making sure those dreams don't become financial nightmares.

Sources:

1. Ratehub, Additional Monthly Costs of Homeownership

2. Wahi 2024 Homeowner Happiness Survey

3. Zoocasa, Canada’s Property Taxes 2024 National Snapshot

4. Harvard Western Insurance, Weather Damage Drives House Insurance Rates Up in Canada

5. Pembina Institute, How Governments and Insurers Can Help Lower Soaring Home Insurance Costs

6. Precondo, Maintenance Fees for Condos in Canada

7. Statistics Canada, Which households need repairs, and how much more do they cost?

8. Ratehub, How Much Should You Budget for Home Maintenance?

9. Homestars — Roof Replacement Costs in Canada

10. Custom Contracting, How Much Does HVAC Installation Cost in Ontario?

11. HomeAdvisor (Canada, Water Heater Installation Cost

12. Homestars, Foundation Repair Costs

13. Bank of Canada, How Will Mortgage Payments

2026 Canada Housing Market Forecast: Will Buyers Finally Re-Enter the Market? [Jan 2026]

Will 2026 be the year Canadian buyers stop waiting? Most major housing forecasters believe activity will finally pick up after two muted years, but expectations vary on how strong that rebound will be and where it will show up first. After a sluggish and uncertain 2025, the Canadian housing market appears positioned for gradual normalization rather than a sharp recovery.

The Canadian Real Estate Association (CREA) now forecasts national home sales of roughly 509,000 transactions in 2026, representing about 7–8% growth year over year. 1,2 That would place activity above 2025 levels, though still below long-term historical averages. Average prices are expected to return close to the $700,000 range, reflecting modest appreciation rather than a renewed surge. 1,3

The 2025 Context: A Delayed Recovery, Not a Breakdown

In early 2024, CREA projected that 2025 would mark a meaningful rebound year for Canada’s resale market, driven by pent-up demand and easing interest rates.1 By late 2024, that recovery appeared to be forming. Under that forecast, national home sales were expected to exceed 500,000 transactions, with national average prices climbing back toward $700,000.That momentum stalled in early 2025. Trade uncertainty, broader economic unease, and affordability pressures pushed many buyers back to the sidelines, prompting CREA to downgrade its outlook.4 Sales activity softened most noticeably in British Columbia and Ontario, while prices in several major urban markets came under renewed pressure.4,10

Importantly, the market did not deteriorate further. Beginning in spring 2025, CREA data showed a showed continued improvement in sales activity, suggesting that demand was delayed rather than destroyed.⁵ The result is a downward revision to 2025 forecasts, but solid upward momentum heading into 2026, with last year’s 2025 expectations now effectively pushed out one year.1,4

2026 Forecasts: Where Canadian Forecasters Agree and Disagree

Sales Activity: Gradual Thaw, Not a Flood

Sales forecasts for 2026 cluster more tightly in Canada than in the U.S., but uncertainty remains. CREA’s national forecast implies high-single-digit growth, bringing sales back into the low-500,000 range.1,2 RE/MAX Canada similarly expects increased activity, citing improving consumer confidence and buyers adjusting to current financing realities.9The central uncertainty is not economic capacity but psychology. Many Canadian buyers spent the past two years waiting for more aggressive rate cuts or price declines. As those expectations fade, the decision to re-enter the market increasingly hinges on life events, job changes, family needs, downsizing, or relocation, rather than market timing.3,7

Unlike the pandemic rebound, 2026 is unlikely to bring a surge of speculative or urgency-driven buying. Instead, forecasters expect incremental increases in transaction volume, market by market, price tier by price tier.9,14

Home Prices: A Tug-of-War Between Growth and Correction

Price forecasts for 2026 reveal a rare divergence among Canada’s top housing analysts, signaling a market in transition. While the consensus points to stability, experts disagree on whether the national average will tick up or drift slightly lower.CREA projects the national average home price to rise roughly 3.2% in 2026, returning close to the $700,000 mark.1,2 This aligns with Royal LePage’s outlook, which forecasts aggregate price growth of approximately 1%, supported by steady demand in more affordable provinces.7

However, not all outlooks are positive. RE/MAX Canada stands as a notable outlier, forecasting a national average price decline of roughly 3.7%, despite rising sales activity.9 This bearish view highlights the heavy weight of inventory buildup in Canada’s most expensive markets.

The "Two-Speed" Market Continues Regardless of the national average, all forecasters agree on a widening regional gap:

- The Correction Markets: Higher-priced regions like Greater Toronto and Greater Vancouver are expected to see flat to negative price movement. Here, affordability ceilings have been hit, and listing inventory is rising faster than sales.7,8

- The Growth Markets: In contrast, affordable regions, specifically Alberta, Quebec, and Atlantic Canada are forecast to outperform. These markets continue to attract inter-provincial migration and offer entry points that first-time buyers can actually afford.7,8

Interest Rates and Affordability: Stability Over Relief

Unlike the U.S., Canadian mortgage expectations hinge on Bank of Canada policy rather than long-term bond-market forecasts. Current consensus suggests the policy rate is nearing a plateau, with rate cuts largely behind us and borrowing costs expected to remain relatively stable into 2026.12,13For buyers and sellers, this means rate stability matters more than rate relief. While borrowing costs may ease modestly, affordability improvements are expected to come gradually through income growth and slower price appreciation rather than dramatic financing changes.3,13

The practical implication mirrors the U.S. experience: waiting for a return to 2020–2021 conditions is increasingly unrealistic. The market is adjusting to a higher-rate baseline, and participants must plan accordingly.3,7

What This Means for Buyers

For buyers, 2026 offers improved conditions compared with the past two years—but not a buyer’s market across the board. Inventory has increased modestly, competition has cooled, and bidding wars are less common outside of the most desirable properties and locations.2,4At the same time, prices are not expected to fall meaningfully at the national level. Waiting may result in slightly better selection or marginally lower borrowing costs, but not dramatically cheaper homes.1,3,7 As a result, the advantage in 2026 lies with prepared buyers: those with financing in place, realistic expectations, and flexibility on timing or location.

First-time buyers continue to face the steepest challenges. High upfront costs and qualifying constraints remain barriers, particularly in major metros.14 However, slower price growth and calmer competition give first-time buyers more room to negotiate and plan than during the pandemic surge.9

What This Means for Sellers

For sellers, 2026 is likely to feel more balanced and more demanding than recent years. The automatic leverage sellers enjoyed during the pandemic has faded. Outcomes will depend heavily on pricing accuracy, property condition, and local supply-demand dynamics.7,10Overpricing carries greater risk in a market where buyers are patient and well informed. Homes that are priced correctly and well prepared should still sell efficiently, while those anchored to peak-era expectations may linger.7,10 Concessions and strategic preparation are once again meaningful differentiators rather than optional extras.10

The lock-in effect remains a consideration for homeowners with very low mortgage rates, but life events and accumulated equity increasingly outweigh rate comparisons.11,14 As in the U.S., sellers are slowly recalibrating to the reality that today’s rates are durable, not temporary.

Renters and the Rent-vs-Buy Decision

For renters, 2026 remains a pragmatic decision year rather than a forced transition point. Renting often continues to offer lower short-term costs and flexibility, particularly in high-priced markets.14,15 At the same time, modest price appreciation suggests that waiting indefinitely may not yield better entry points.1,3For those planning to buy in the future, 2026 is best viewed as a preparation window strengthening credit, building savings, and identifying target markets, rather than a year of dramatic opportunity or risk.15

Conclusion: A Market Returning to Rhythm

The 2026 Canadian housing market is defined less by recovery than by normalization. Sales activity is expected to rise modestly. Prices should increase slowly, with wide regional variation. Interest rates are stabilizing rather than collapsing. The extremes of the pandemic era are firmly behind us.Success in 2026 will not come from timing the market perfectly, but from adapting to it. Buyers gain more choice and negotiating room but face ongoing affordability challenges. Sellers retain advantages in undersupplied markets but must price and prepare carefully. Renters balance flexibility against long-term ownership goals.

As the market settles into a more sustainable rhythm, realistic expectations and local expertise matter far more than bold predictions.

Source:

1. Canadian Real Estate Association (CREA).

CREA Updates Resale Housing Market Forecasts for 2025 and 2026.

2. CREA. Quarterly Canadian Housing Market Forecasts.

3. Yahoo Finance Canada. Home prices expected to tick higher in 2026 as sales rebound.

4. Mortgage Professional Canada (MPA). CREA trims 2025 home sales forecast as buyers delay return.

5. CREA. Canadian home sales edge up again following third interest rate cut.

6. CBC News. Canadian home sales rise as buyers slowly return.

7. Royal LePage. Canada’s housing market poised for a reset in 2026.

8. Royal LePage. A reset is in store for Canada’s housing market in 2026.

9. RE/MAX Canada. Canadian Housing Market Outlook.

10. Real Estate Magazine. CREA downgrades housing market forecast.

11. Real Estate Magazine. Five years of market swings set the stage for 2026.

12. Reuters. Bank of Canada seen holding rates as housing stabilizes.

13. Bank of Canada. Monetary Policy Reports & Rate Announcements.

14. Mortgage Professional Canada (MPA). Buyers could edge back to Canada’s housing market in 2026, says Royal LePage.

15. Real Estate Magazine. Real estate trends for 2026: Why Canada’s future may be brighter than it looks.

Planning Your 2026 Real Estate Moves: A Guide to the Best Buying and Selling Seasons [Dec 2025]

Timing isn’t everything in real estate, but it can still be the difference between saving real money or paying a premium, selling in 30 days or sitting for three months, and negotiating from a position of strength or uncertainty. As we look toward 2026, that timing question matters even more in Canada. CREA is calling for a modest pickup in activity into 2026 as rates ease and confidence returns, which means we’re heading back into a more “normal” seasonal market, not the anything-goes conditions of the pandemic years.1 Knowing when to make your move can have a real impact on the outcome.

The challenge? Not everyone gets to wait for the “perfect” month. Job relocations still happen in January. Military, government and corporate transfers often target late spring. Families want to be settled before school starts in September. So instead of chasing a mythical best week, it’s smarter to understand how each Canadian season behaves and then work inside your timeline.

Spring: Peak Selling Season (March–May)

Spring isn’t called peak season by accident. The Canadian market quite literally wakes up after winter. National brokerages like RE/MAX and Royal LePage say the same thing every year: spring is the most desirable time to list because homes simply show better, buyer traffic is higher, and many buyers want to close in time to move over the summer.3,4 A 2024 analysis from Zoocasa looking at several major Canadian markets showed the same pattern, activity typically ramps up in March, peaks through April and May, and in some years even starts a touch earlier as buyers try to get ahead of the spring rush.2

Buyer psychology helps. Longer daylight means more evening showings. Melting snow and fresh landscaping make detached homes look their best. And families with school aged kids start shopping in March and April so they can move in July or August. In years when inventory is tight in Toronto, Vancouver, Ottawa/Gatineau or Victoria, this spring surge can still create multiple-offer situations especially on well-priced, well-located properties. That will be even more likely if 2025’s softer prices tempt more buyers back in 2026.

The Competition Factor

Of course, spring’s upside comes with a trade-off: everyone else knows it’s a good time too. More listings hit the market, so sellers have to do the basics well accurate pricing, strong photos, pre-list prep, and real marketing to stand out. Buyers benefit from more choice, but they also face the most competition for the “nice” listings. In hot pockets of the GTA, Calgary, Halifax or parts of the Lower Mainland, that can still mean acting quickly and writing tighter offers than you would in October.

Summer: Extended Peak Season (June–August)

As spring rolls into summer, the Canadian market usually keeps much of its momentum. June is often one of the busiest closing months of the year, and in Quebec there’s an extra push because so many leases turn over on or around July 1 “moving day” which keeps trucks, buyers, and sellers active.6

Summer lines up perfectly with family life. Kids are out of school, weather is predictable, cottages are opening, and people have time to tour. Outdoor features also show at their absolute best decks, patios, rooftop terraces, west-facing balconies in Vancouver, even small yards in Toronto. Buyers will often pay a convenience premium here because moving in July is simply easier than moving in January.

By late August, however, you can feel things shift. Early-summer listings that were too ambitious on price can start to look “stale.” Families are turning their attention back to school. Serious buyers are still around, but urgency eases good news if you were beaten out in June.

A Note on Moving Costs

There’s a very Canadian practical piece people forget: it literally costs more and is harder to book a move in peak season. In Quebec, July 1 is so busy that moving companies advise booking months in advance, and local news outlets report higher rates around that date because demand is intense.6 If your timing is flexible, a late-fall or winter move can save you money.

Fall: Underrated Opportunity Season (September–November)

Fall might be real estate’s best-kept secret on both sides of the transaction. After summer vacations, a lot of qualified buyers come back into the market, but there are usually fewer new listings than in April or May. That combination gives good properties room to stand out. Royal LePage and Global News have both been noting that fall 2025 is showing more balance and a bit more negotiating room, and if that pattern continues, fall 2026 could be an excellent time for buyers who want value without spring’s bidding wars.4,5

For sellers, fall has another quiet advantage: buyers are more serious. Casual browsers drop off once school resumes and weather cools. People shopping in October usually want to be in before snow and holidays. That natural year-end urgency close before winter, avoid carrying costs over the holidays, move before the deep freeze helps deals get done.

This is also when price gaps from summer can show up. As activity cools and more listings sit, buyers can sometimes negotiate a bit more, especially in markets where 2025 softness hasn’t fully cleared out by early 2026. You may not see a giant discount in downtown Toronto or central Vancouver, but you can often get better terms.

Winter: Value Season (December–February)

Winter gets a bad reputation in Canadian real estate because showings are harder, curb appeal is lower, and nobody loves moving in slush. But for buyers with flexibility, winter is often the best value play of the year. Fewer people list when it’s -15°C, so the buyers who are out have more leverage days on market are longer, and sellers who have to sell are more negotiable. CREA’s 2025 numbers already show a market that’s sensitive to confidence and rates; if that softer tone spills into early 2026, winter buyers will be in a good position.1

Winter also tells you the truth about a property. You can see how the home actually handles a Canadian winter drafts, windows, ice dams, heating information you can’t always get from a May showing. That’s powerful for inspections and negotiations.

There are trade-offs, of course. Sellers face the lowest foot traffic of the year, holiday distractions, and limited daylight for showings. Curb appeal is just harder when everything is under snow. But fewer competing listings can work in your favour if you price realistically and present well. Serious buyers will still come out in January especially job relocations.

Regional Differences: Not All Canadian Markets Are Equal

One thing we have to say in a Canadian version of this post: where you live matters a lot. Seasonal swings are sharpest in places with real winters and short construction/moving seasons think the Prairies, Atlantic Canada, and most of Quebec because everyone tries to cram listing, selling, and moving into a six or seven month window. In those places, spring and summer really do carry most of the year’s volume.

In contrast, the BC Lower Mainland and much of Southern Ontario can support more year-round activity because weather is milder and buyers stay engaged. Those markets can have excellent fall seasons, and even winter sales don’t fall off a cliff the way they do in January in Winnipeg.

That’s why your local board stats (TRREB, REBGV, OREB, ACI, Nova Scotia Association of REALTORS®, etc.) and your agent’s read on inventory will always beat national averages. CREA and Royal LePage are both projecting more balance and slightly better affordability into 2026, but how that shows up in Halifax versus Calgary versus Montreal won’t be identical.1,7

Pricing Strategies by Season

Pricing strategy has to move with the season. What works in May doesn’t always work in December.

In spring and early summer, when demand is highest, you can afford to be a little more ambitious especially if your home shows beautifully and there isn’t an identical property for sale on your street. Canadian buyers are used to seeing sharp, competitive pricing in April. A well-marketed, fairly priced listing can still attract multiple offers in 2026 if rates have eased and buyers have come back, as most forecasts suggest.

In fall, it’s smart to price the market you actually have, not the one you remember from May. Slightly more realistic pricing pulls in the serious buyers who came back after summer and want to be in before winter. And in winter, you have to be the most compelling option in your price band. A 5–10% difference in asking price can be the difference between sitting and selling when there are only a handful of active buyers in your segment.

Buyer Offer Strategies by Season

On the buy side, spring and early summer are when you need to be the most organized. Get pre-approved, have your documents ready, and be willing to move fast on the right property. In hotter submarkets, you may still need to improve terms flexible possession, fewer minor asks, or a slightly stronger price to beat other buyers.

Fall and winter, by contrast, are when you can ask for more. Smaller buyer pools mean more leverage: closing-cost help, small repairs, longer condition periods, even winter move-in credits if snow removal or storage is an issue. Motivated sellers tend to be most flexible late in the year.

Bottom Line

Seasonality still matters in Canada. Spring and early summer deliver the best visibility and fastest sales. Fall is quieter but often smarter. Winter rewards flexible buyers. But your personal timeline, your province’s climate, and 2026’s rate path should drive the decision more than a calendar myth.

If you tell me which market you’re in GTA, Lower Mainland, Calgary/Edmonton, Atlantic, or QuebecI ca n tighten this even further to match your board’s typical seasonal pattern for 2026.

References

1. Canadian Real Estate Association. “CREA updates resale housing market forecasts for 2025 and 2026.” Oct. 16, 2025.

2. Zoocasa. “Spring’s Impact on Canadian Home Sales.”

3. RE/MAX Canada. “Is Now the Best Time to Sell?”

4. Royal LePage. “Slight uptick in activity as fall housing market gets underway, price growth lags behind.” Oct. 15, 2025.

5. Global News. “Fall housing market moving towards a ‘balance.’” Oct. 15, 2025.

6. North Shore News (Canadian Press). “Quebec’s traditional moving day arrives as thousands still looking for new homes.” July 1, 2025.

7. Royal LePage. “Canadian home sales ease in September after five-month streak of gains.” Oct. 16, 2025.

Can You Really Trust Online Home Valuations? [Nov 2025]

For millions of Canadians, the home‑search journey often starts on REALTOR.ca Canada’s largest real estate platform and continues across consumer portals and brokerage sites. Along the way, many homeowners encounter online valuation widgets (AVMs) from data apps and brokerages (e.g., HouseSigma, Zolo, and others) that promise an instant estimate of value. The appeal is obvious: quick, free, and convenient.

A quick caution before we go further: even the best‑known U.S. portals frame their AVMs as starting points, not appraisals and high‑profile misses have made headlines.1 The lesson applies in Canada too: an automated number is helpful for curiosity, but risky as a pricing strategy.

In this article, we'll examine how these powerful algorithms work, reveal the data behind their wildly varying accuracy rates, identify what they systematically miss, and show why local human expertise remains irreplaceable when precision and your equity matters most.

How These Algorithms Actually Calculate Your Home's Value

Automated Valuation Models are algorithms designed to crunch massive amounts of data in seconds.3 Think of them as sophisticated calculators—impressive in computational power, but limited by the quality and completeness of their inputs.

These systems analyze public records, tax assessments, recent comparable sales, and basic property characteristics like bedrooms, bathrooms, and square footage.4 For standard properties with plenty of recent comparable sales, this data-driven approach can produce reasonable estimates.

But here's the fundamental limitation that shapes everything else we'll discuss: these models rely purely on historical data and never actually visit your property. They're backward-looking by design, using what sold yesterday to predict what might sell tomorrow, and while an algorithm can tell you that your home has three bedrooms, it cannot tell you that the primary suite has stunning morning light that makes buyers fall in love.

Accuracy and When Online Estimates Miss the Mark

Now for the numbers that every homeowner needs to understand.

When discussing AVM accuracy, you'll encounter the term "median error rate." This measures how far the estimate typically deviates from the actual sale price—specifically, half of all estimates fall within this percentage, and half fall outside it.2 Lower is obviously better, but context is everything.

The U.S. Benchmark: Zillow and Redfin

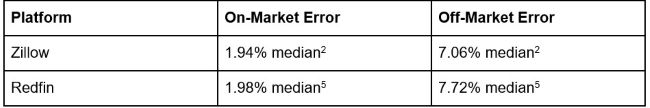

While Canada’s leading portals such as REALTOR.ca, HouseSigma, and Zolo do not publish their own first-party accuracy data, their U.S. counterparts do. These figures provide a useful benchmark for understanding the potential variability of automated estimates:

Canadian Context

In Canada, popular home search platforms like HouseSigma and Zolo provide home estimates but do not publicly disclose error rates or accuracy metrics. That means there’s no transparent standard for how close those estimates typically come to actual sale prices. Based on industry experience and the same underlying data constraints, Canadian AVM accuracy is likely to vary just as much or more than the U.S.

This is especially true in markets with low inventory, unique properties, or rapidly shifting conditions, where algorithms have fewer comparable sales to draw from.

What This Means in Actual Dollars

Let's make this tangible for Canada. On a $1,000,000 home, a 7% median error translates to ±$70,000 or more–and remember, that's the median, meaning half of all estimates miss by even more than that. For a $800,000 property, you're looking at potential discrepancies exceeding $55,000. For luxury homes, the gap can easily reach six figures. The difference between an accurate valuation and an algorithm's best guess can be immense so it’s important to understand their limitations.

The Algorithm's Blind Spots: What Online Estimates Cannot See

If AVMs have access to so much data, why do they miss by such significant margins? The answer lies in what they can't measure.

The Condition Conundrum

This is the AVM's Achilles heel. Every algorithm must assume your home is in "average condition." Your newly renovated kitchen with custom cabinetry? Average. Your finished basement adding 600 square feet? Average. Your brand-new HVAC system? Average. Flip it arounddeferred maintenance, a crumbling driveway, outdated bathrooms all get the same treatment. This isn't minor condition often accounts for significant price variations between otherwise identical properties.

Location Nuances and Human Appeal

Algorithms understand neighborhoods but struggle with subtleties. Two identical homes one on a quiet cul-de-sac, another backing a busy road. Same value to an algorithm, vastly different to buyers.

Market Lag and Unique Properties

Because AVMs depend on historical sales data, they lag behind current conditions. In rapidly moving markets, this lag can render estimates nearly useless. For custom homes, luxury properties, or anything unique, AVMs often fail completely there simply aren't comparable sales to analyze.

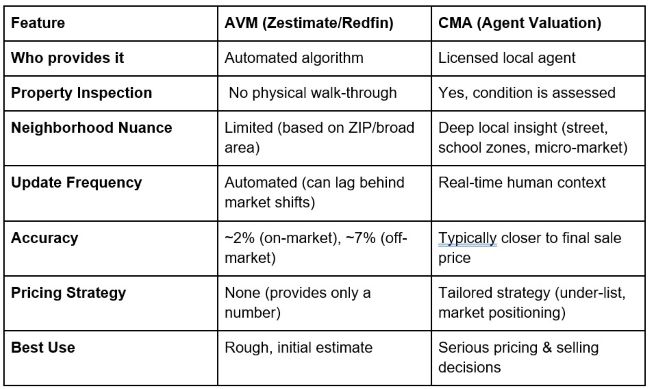

The Solution: Why a CMA Is the Indispensable Tool

A Comparative Market Analysis (CMA) is the professional valuation tool that real estate agents provide. It's the bridge between raw data and real-world value combining analytical power with human expertise and local knowledge.

What Makes a CMA Superior

Physical Inspection: Unlike an algorithm, your agent actually walks through your home. They see the quality of updates, evaluate floor plan flow, notice natural light, and assess the overall "feel" that influences buyer psychology. They identify value-adding features no database captures.

Micro-Local Knowledge: Micro-local effects (e.g., street-by-street premiums in Toronto’s TRREB area or Vancouver’s REBGV area) are hard for national algorithms to capture and are exactly what a local CMA is built to adjust for. Agents live and breathe their local markets. They explain not just what your home is worth, but why and how to position it strategically.

Real, Adjusted Comparables: Your agent doesn't just pull recent sales they analyze and adjust them. They can justify why your home is worth $90,000 more than one down the street: "Their kitchen had 1990s oak cabinets; yours has modern shaker style buyers want, justifying a $15,000 adjustment. They had builder-grade carpet; you have refinished hardwood, worth another $10,000."

Why Pricing Correctly From Day One Matters

For sellers, an accurate CMA prevents the two most expensive mistakes. Overpricing based on an inflated estimate leads to your home sitting stagnant each week without offers damages your negotiating position and ultimately results in selling for less than if you'd priced correctly initially. Underpricing based on a conservative algorithm means leaving tens of thousands on the table. In real estate, you rarely get a second chance at a first impression. The initial listing price sets market perception, and getting it right requires the precision only a CMA provides.

When Online Valuations are Useful

For Sellers: Never set your listing price based solely on an online estimate. Use it as a conversation starter, but rely on your agent's CMA to build a strategic, defensible pricing plan.

For Buyers: Use online estimates to establish a general ballpark before you start searching, but trust your agent's analysis of recent comparable sales when crafting offers. The algorithm doesn't know that three other buyers are submitting offers this weekend your agent does.

BOTTOMLINE: Technology Is a Tool, Not a Guide

Online home valuations are impressive tools for satisfying curiosity, but they remain prone to significant error especially for off-market properties where median error rates of 7-8% translate to tens of thousands of real dollars. The blind spots around condition, location nuances, and market timing aren't minor technical limitations they're fundamental gaps that only human expertise can fill.

When it comes to your largest financial asset and a decision that will impact your life for years, technology can give you a ballpark, but only a professional CMA can give you the strategic precision you need.

Ready to know what your home is really worth? Contact us today for a complimentary Comparative Market Analysis a personalized, in-person valuation that examines your specific property, incorporates current market dynamics, and provides the strategic guidance the internet simply cannot match.

Sources

1. Inman

2. Zillow Zestimate Accuracy

3. Rocket Mortgage: Automated Valuation Model

4. Experian: What Is an Automated Valuation Model -

5. Redfin

How to Spot Real Estate Scams (and Protect Your Investment) Canada [Oct 2025]

Real estate scams are targeting more victims than ever before, and they're becoming increasingly sophisticated. Canadians reported losing $638 million to fraud in 2024, with authorities warning that only 5–10% of incidents are reported at all¹. Even more concerning, Canadian lawyers, title insurers and regulators have flagged a rise in identity-based title and mortgage fraud during real estate closings, where large deposits and tight timelines create opportunities for criminals².These aren't isolated incidents targeting the naïve or unprepared, they're professional operations that can fool experienced investors and savvy consumers alike. Scammers have adapted to modern technology and remote transactions, making their schemes harder to detect and more financially devastating than ever.

The shift to digital communications and remote closings has created new vulnerabilities that criminals actively exploit. Whether you're a first-time home buyer, seasoned investor, property owner, or renter, understanding these threats and knowing how to protect yourself is essential. From wire-transfer hijacking to fake listings, title theft, and impostor agents, real estate scams come in many forms. Here's how to recognize and protect yourself from the most common threats.

Wire Transfer Fraud: The Costliest Threat

Wire fraud strikes at closing when buyers are most vulnerable. Criminals hack or spoof emails from real estate professionals or law firms, then send fake wiring instructions directing your down payment to their accounts. The setup appears completely legitimate, the email looks official, uses proper terminology, and creates urgency around closing deadlines.

In Canada, deposits are typically handled through lawyers'/notaries' trust accounts, but that doesn't eliminate risk. CREA and Canadian practitioners warn that wire transfers are designed to be irreversible, and once funds leave your account, recovery is unlikely³. For many Canadian homebuyers, typical losses can reach six figures, representing their entire life savings and down payment.

Critical warning signs include:

- Last-minute wiring instruction changes labelled "urgent" or citing a "closing emergency"

- Email address anomalies with letters off or different domains (e.g., titlle-co.ca instead of title-co.ca)

- Pressure tactics demanding immediate action to avoid delays

If fraud occurs, contact your bank immediately, then report to local police and the Canadian Anti-Fraud Centre (CAFC) without delay.

Rental Listing Scams: Too Good to Be True

Rental scams use fake listings or fraudulent "landlords" to collect upfront payments for properties that don't exist or aren't actually available. Scammers copy real listings with gorgeous photos and below-market rents to lure victims—especially in tight rental markets.

Urgency tactics can be persuasive. The emotional manipulation is deliberate—scammers create urgency by claiming multiple interested renters or limited availability. They often pose as property managers or landlords who are conveniently out of the province, overseas for work, or on missionary trips.

Red flags include:

- Unusually low rent for the area or property quality

- "Landlords" who claim they're out of the province/country and can't meet in person

- Upfront payment requests (e-transfer, wire, crypto, gift cards) before viewing or signing

Never send money for rentals you haven't verified. Insist on inspecting properties before paying anything and verify ownership via your provincial land registry. Use trusted channels and beware of pressure to "hold" the unit with a deposit.

Homeowners can also be targeted when scammers impersonate owners to illegally rent out vacant homes. If you own vacant property, monitor for fake rental ads using your address.

Title and Deed (Land Title) Fraud: Stealing Your Home

Title fraud involves criminals forging transfer documents and/or using stolen identities to take out mortgages or even sell your home without your knowledge. Vacant homes, investment properties, and mortgage-free homes are prime targets because fraud is less likely to be detected quickly.

One insurance investigator documented at least 30 homes sold through total title fraud in the Greater Toronto Area over an 18-month period⁵. In one documented case, an Etobicoke couple who moved overseas for work discovered criminals had fraudulently sold their home while they were abroad. The couple only learned about the sale months later when strangers were found living in their house⁶.

Warning signs include:

- Unusual mail, such as notices of new mortgages you didn't initiate

- Stopped property tax bills or deed/ownership notices you don't recognize

- Unexpected default, power-of-sale, or foreclosure notices

Protect yourself:

- Check your title periodically via your provincial land registry office and consider title insurance

- Set up title/activity alerts where available

- Guard your personal information carefully; identity theft is often the gateway to title fraud

Fake Buyers, Sellers, and Real Estate Professionals

Identity scams involve criminals impersonating transaction parties or real estate professionals.

Fake buyer scams target home sellers with attractive cash offers, then send bogus bank drafts/certified cheques for deposits, often overpaying and asking sellers to wire back the difference.

Seller impersonation has surged across Canada, with criminals posing as property owners to list and sell properties without authorization. Impostor agents/brokers create phoney profiles, sometimes stealing legitimate agents' names and photos. In May 2025, a Brampton man was charged with fraud for allegedly collecting nearly $170,000 in deposits from nine homebuyers for pre-construction homes he had no right to sell⁷.

Always verify identities and licences through your provincial regulator (e.g., RECO in Ontario, BCFSA/RECBC in BC, RECA in Alberta)⁹. Ask for government-issued photo ID and independently verify property ownership through the land registry.

Bait-and-Switch Schemes

These scams promise attractive deals, then switch to inferior terms once you're hooked.

Rental bait-and-switch advertises great properties that are suddenly "unavailable," then pushes less desirable alternatives at higher prices.

"We Buy Houses" schemes offer inflated purchase prices, then renegotiate last-minute or assign contracts to other buyers, often leaving sellers with well-below market outcomes.

Mortgage bait-and-switch promises unrealistic rates requiring upfront fees, then switches to higher rates. In Canada, claims that sidestep the federal mortgage stress test are red flags.

Trust your instincts when deals change suddenly or seem too good to be true. Get all offers in writing and avoid non-refundable upfront fees.

Best Practices: Your Defence Strategy (Canada)

Work with licensed professionals. Use reputable real estate agents, lawyers/notaries, and mortgage brokers. Verify licences with your provincial regulator.

Verify all identities. Ask for photo ID and confirm credentials independently. Meet in person when possible, and confirm trust account details by phone using a verified number.

Protect personal information. Use strong passwords, enable two-factor authentication, and never email sensitive financial data.

Avoid pressure tactics. Legitimate deals don't require bypassing verification safeguards or making instant deposits.

Use secure payment methods. Deposits should go to verified lawyer/notary or brokerage trust accounts. Avoid cash, gift cards, crypto, or e-transfers to individuals.

Monitor your property. Regularly check land title records and set up alerts or use title insurance where available.

Report suspected fraud. Contact your bank and local police, then report to the Canadian Anti-Fraud Centre (CAFC)⁸.

BOTTOM LINE

Real estate scams exploit trust and urgency, but the warning signs are consistent: bypassed safeguards, pressure tactics, unverified identities, and deals too good to be true. Protection comes from verification, patience, and working with experienced Canadian professionals who can spot red flags.

Whether you're buying, selling, or renting, take time to properly vet every aspect of your transaction. If something feels wrong, pause and investigate—it's better to lose a "great" deal than become a fraud victim.

Planning a real estate transaction in Canada? Let's discuss how to protect your investment while achieving your goals. An experienced Canadian agent can help you navigate the process safely and spot potential scams before they become costly problems.

Sources

1. Competition Bureau Canada

2. CityNews

3. Canadian Real Estate Association

4. Canada Mortgage and Housing Corporation

5. Maclean's

6. CBC News

7. CBC News

8. Financial Consumer Agency of Canada

9. Richmond RCMP

What Makes a Great Long-Term Rental Property? A Checklist for Smart Investors [Sep 2025]

- Real estate remains among Canada’s top choices for building long-term wealth. A recent survey found that 87% of Canadians feel more confident investing in real estate than in publicly traded stocks. This isn't just sentiment; 76% of the Canadian real estate investors surveyed own properties beyond their primary residence.1

When executed wisely, rental properties can deliver steady cash flow today and significant wealth tomorrow. But success starts with preparation—knowing how rentals make money, who is best suited to invest, what to look for, and where to start.

How Rental Properties Build Wealth

Great rental properties create wealth through three primary channels that work together to compound returns over time:

- Cash Flow represents net monthly income after expenses. The formula: Total rent minus all expenses (mortgage, taxes, insurance, maintenance, management fees, etc.). A duplex renting for $3,300 monthly with $2,700 in expenses generates $600 monthly positive cash flow—money for profit or reinvestment.

- Appreciation refers to property value increases over time. According to Canadian MoneySaver, nationally, the housing market has averaged 6% yearly appreciation since 1975.4 A 6% annual appreciation on a $400,000 house adds $24,000+ to your equity annually from market gains alone.

- Equity growth also occurs as mortgage payments reduce loan principal. Ideally, tenant rent effectively covers these payments, so tenants are purchasing the property for you incrementally. If $500 monthly goes toward principal, you gain $6,000 in equity annually. The total return combines all three elements. While individual components might not create overnight wealth, together they compound impressively for patient investors.

Rental property investing isn’t for everyone. The most successful investors tend to share a few traits:

- Long-term wealth builders with financial stability and risk tolerance typically succeed. Investment properties require substantial down payments (minimum of 20% in Canada) plus cash reserves for maintenance and vacancies.2 You need stable finances with emergency funds before investing, as real estate is illiquid.

- Detail-oriented, patient investors often find the greatest success navigating Canada's provincial regulations. Smart investors educate themselves about tax implications, landlord-tenant laws, and analyze numbers carefully.

- Hands-on, resourceful owners who can handle basic maintenance, repairs, and tenant management themselves also have an advantage. These investors can save thousands each year on property management and service fees, boosting overall returns. If you align with these traits, rental property investing can be a powerful tool for building lasting wealth.

The first step is to contact an investment-savvy real estate agent. We can be an invaluable partner in finding and securing great properties by offering:

- Access to MLS data and off-market deals that you can’t find on your own. We have extensive networks and can sometimes help you uncover properties before they are publicly listed.

- Expert market knowledge to help you choose the right property. We know which neighbourhoods, property types, and home features are the most desirable to renters in our area.

- Deal analysis assistance to maximize your returns. We can help you estimate cash flow, cap rates, and return on investment.

- Ongoing network support that extends beyond closing. We maintain networks of reliable contractors, property managers, investor-friendly lenders, and insurance brokers.

Your Rental Property Evaluation Checklist

Not all rental properties offer equal investment potential. Smart investors use systematic criteria to identify truly great opportunities:

- Location & Market

Analysis Location determines everything—tenant quality, rental demand, and appreciation potential. Focus on areas with strong rental demand near employment centers, universities, or transit systems, ensuring steady tenant pools.

Research local vacancy rates carefully. High neighbourhood vacancy signals low demand, while low vacancy allows rent increases. Investigate safety and school quality—properties in low-crime areas with good schools attract stable, long-term tenants.5

Evaluate regional economic and immigration trends beyond immediate neighbourhoods. Growing employment opportunities drive housing demand. Research major employers that are expanding but avoid areas dependent on single industries. Check government infrastructure plans—new transit or development projects can boost values, but excessive new development might increase competition.5 - Financial Analysis

Perform detailed cash flow analysis for every potential property. Calculate expected rent and subtract all expenses: mortgage payments, property taxes, insurance, fees, management costs, maintenance reserves (budget 10% of rent), and vacancy allowances.

Run sensitivity analysis: What happens if rents drop 5% or expenses increase 10%? Great properties remain profitable under various conditions. - Property Condition & Carrying Costs

Physical condition directly impacts returns. Older homes with outdated systems may require frequent, costly repairs. Schedule professional inspections focusing on major components: roof, foundation, electrical, plumbing, and HVAC systems.

Consider property layout—standard configurations like 3-bedroom/2-bathroom homes appeal to broader tenant bases than unusual layouts. Factor in capital expenditure timelines for major items needing replacement every 15-30 years.

Research property tax rates carefully, as they vary significantly by province and municipality, with some jurisdictions offering different rates for investment versus principal residence. Get insurance quotes before purchasing, especially for properties in disaster-prone areas requiring expensive additional coverage. - Property Type Selection

For most investors, single-family homes or condominiums offer the best starting point. Single-family homes typically attract longer-term tenants who treat the property as their home, resulting in steadier income.5

Unless you’re planning to use your property as a short-term or vacation rental, avoid highly specialized properties like luxury mansions or tiny studios targeting niche markets with higher vacancy risks. “Bread and butter” 2-4 bedroom homes in middle-class neighbourhoods form successful long-term rental portfolio foundations.5 - Due Diligence Requirements

Verify all numbers independently. Research comparable rents for similar nearby properties, ensuring realistic projections.6 Check sales comparables to avoid overpaying. Schedule professional inspections and read reports thoroughly—unexpected problems can transform great deals into money pits.

Understand local landlord-tenant laws covering eviction processes and deposit rules. Consult professionals, as needed, for valuable guidance.

If this checklist seems overwhelming, don’t worry! We can help with each of these items. By following this checklist, we’ll separate high-performing rental opportunities from costly mistakes and position you for long-term success.

BOTTOM LINE

Great rental properties aren't found by chance—they're identified through systematic evaluation. Properties that build lasting wealth combine healthy cash flow, solid locations, sound physical condition, and strong growth potential.

Success requires patience, proper analysis, and the right team. While markets fluctuate, well-chosen properties consistently reward investors through income, appreciation, and equity growth, creating real wealth over time.

Ready to start building wealth through rental property investment? The fundamentals we’ve outlined provide your foundation, but local market expertise and deal analysis make the difference between mediocre and exceptional investments. Let's discuss how these principles apply to current opportunities in your target market.

Sources

1. Real Estate Magazine

2. RBC

3. Government of Canada

4. Canadian MoneySaver

5. Investopedia

6. Ivestopedia

10 Hidden Home Maintenance Tasks That Could Save You Thousands [Aug 2025]

As a homeowner, you’re likely diligent about the basics—mowing the lawn, touching up paint, and cleaning regularly. But what about the critical home maintenance tasks you don’t see every day?

Research shows that home maintenance frequently takes a backseat, even with the best intentions. In fact, a recent survey found that 60% of homeowners have postponed necessary maintenance or repairs, while 40% admit to paying for a major home repair that could have been avoided with better upkeep.1

Still, it’s not just about avoiding costly emergencies—it’s also about maximizing the return on your biggest investment. According to research by Thumbtack, homeowners who do put in the extra care are rewarded: Well-maintained homes sell for an average of 10% more.2

Let’s explore 10 often overlooked home maintenance tasks and how they can save you thousands in long-term costs.

1. Gutter Cleaning: Your First Line of Protection

Clogged gutters can cause water to overflow and seep into your home’s foundation, attic, or siding. Left unchecked, this can lead to foundation damage, rot, and even flooding.

The real cost of neglect: While professional gutter cleaning averages $212, it’s far less than the potential repair bills.3 The average cost to repair a flooded basement, for example, is a whopping $43,000 according to the Government of Canada.4

Your action plan:

- Clean gutters at least twice annually—in spring and fall.

- Use a gutter scoop or hose to remove debris.

- Consider investing in gutter guards to reduce future clogs.

2. HVAC Filter Replacement: Small Task, Major Impact

A dirty HVAC filter reduces airflow, causes your system to work harder, and increases energy use. It can also lead to health concerns from trapped contaminants circulating in your home’s air.

The hidden costs: Natural Resources Canada confirms that routine maintenance, including replacing clogged filters, can reduce energy consumption by 10-20%.5 Neglected maintenance, on the other hand, can lead to higher utility bills and costly repairs.

Your maintenance routine:

- Replace filters every 1–3 months, depending on filter type, usage, and the number of pets in your home.

- Opt for MERV 8–13 filters for efficiency and air quality balance.

- Schedule annual professional servicing (around $100-$250) to catch hidden issues early.6

3. Water Heater Flushing: Preventing Sediment Buildup

Over time, sediment accumulates in your water heater tank, reducing efficiency and shortening the unit's lifespan. Left unchecked, this buildup can cause leaks or complete tank failure.

The financial reality: Regular flushing prevents early replacement and may be required to maintain your water heater’s warranty. You can do it yourself or hire a professional.7

Your annual process:

- Turn off power and water supply to the unit

- Attach a hose to the drain valve and empty the tank completely

- Check your anode rod; it may need to be replaced every 3–5 years.

4. Dryer Vent Cleaning: A Critical Safety Task

Lint-clogged dryer vents aren't just an efficiency problem—they're a common cause of house fires in Canada.8 They also force your dryer to work harder and longer for each load.

The cost factor: Professional cleaning averages $100-$200 nationally, while fire-related damage can run into the tens of thousands.9

Your safety protocol:

- Clean dryer vents every six months using a brush kit, or call in a professional.

- Replace plastic ducts with rigid metal ones, which resist lint clogs.

- Monitor drying times—longer than usual may signal a blockage.

5. Refrigerator Coil Cleaning: The 35% Energy Drain

Your refrigerator’s coils help expel heat. When coated in dust, they force the compressor to work harder, increasing energy bills and shortening appliance lifespan.

The efficiency impact: Dirty coils can increase energy use by up to 35% and, over time, can lead to costly repairs or replacement.10

Your simple solution:

- Check your manufacturer’s guidelines; many recommend cleaning every six months.

- Locate coils behind or at the bottom of the unit and use a vacuum or coil brush to remove dust and debris.

- Keep condenser fan areas unobstructed.

6. Garage Door Lubrication: Prevents Costly Repairs

A squeaky garage door means friction—and friction leads to wear on moving parts, costly spring damage, and failed openers.

The mechanical reality: A new garage door can cost around $2000, while a can of lubricant only costs about $10.11

Your annual routine:

- Check the manufacturer’s guidelines to choose the right lubricant for your garage door.

- Prioritize safety: Ensure the door is fully closed and cut the electricity.

- Check for any signs of damage before proceeding, and call in a pro if needed.12

7. Sump Pump Testing: Your Basement's Guardian

Your sump pump quietly protects your basement from water damage—but it needs testing to ensure it works when you need it most.

The flood prevention factor: Sump pump failure during a storm can result in tens of thousands of dollars in cleanup costs.4

Your quarterly test:

- Pour water into the pit to ensure the float triggers the pump.

- Confirm pump and drainage are working correctly.

- Clean the inlet screen once per year to avoid clogs.

8. Chimney Cleaning: Preventing House Fires

Creosote buildup in chimneys is a common cause of Canadian house fires in the fall and spring.13

The fire prevention imperative: Professional cleaning can cost a few hundred dollars, but it’s crucial for anyone burning wood. The cost of ignoring this task includes chimney repairs and fire damage that can devastate homes.14

Your annual safety check:

- Hire professionals for a thorough inspection and sweeping.

- Use only seasoned wood to reduce creosote buildup.

- Install a chimney cap to block debris and critters.

9. Roof Inspection: Protecting Your Shelter

Missing shingles, damaged flashing, or small leaks can quickly escalate into structural damage and mould problems if left unaddressed. Canada's harsh weather conditions make regular roof inspections particularly crucial.

The structural stakes: Roof inspections can cost a few hundred dollars, while full replacements typically cost $4-$7 per square foot for an asphalt shingle roof.15

Your inspection process:

- Twice per year, perform a DIY inspection for missing shingles, cracked flashing, and sagging areas.

- Check your attic for stains or leaks after rainfall.

- Consider a professional inspection every 1-2 years, depending on your risk factors.16

10. Water Pressure Monitoring: Protecting Your Plumbing

Many homeowners never check their home’s water pressure, but levels above 80 psi can damage pipes, appliances, and fixtures throughout your home, leading to premature failures and leaks.

The pressure problem: Water pressure that’s too high can damage your pipes and lead to expensive repairs or flooding. Pressure that’s too low can impact the performance of your faucets and appliances.17

Your annual check:

- Use a water pressure gauge connected to an outdoor faucet.

- Ideal pressure: 40-60 psi. Install a regulator if it runs high.

- Monitor for sudden changes that could signal a plumbing issue.17

Creating Your Home Maintenance Schedule

Rather than reacting to emergencies, create a proactive plan. Here's a maintenance chart that puts it all in one place:

| Task | Frequency | Key Tools Materials |

|---|---|---|

| Gutter cleaning | Every 6 months | Gutter scoop, hose |

| HVAC filter change | 1–3 months |

MERV 8–13 filters |

| Water heater flush | Annual | Hose, wrench |

| Dryer vent cleaning | Every 6 months | Brush kit |

| Refrigerator coil clean | Every 6 months | Vacuum, coil brush |

| Garage door lubrication | Annual | Lubricant |

| Sump pump testing | Quarterly | Bucket of water |

| Chimney cleaning | Annual | Professional tools |

| Roof inspection | Every 6 months (DIY); 1-2 years (professional) |

Binoculars, ladder or drone |

| Water pressure test | Annual | Water pressure gauge |

BOTTOM LINE

Proactive home maintenance isn’t optional, it’s essential. The ten tasks above are often overlooked, but they’re critical to preserving your home’s safety, energy efficiency, and resale value.

Ultimately, your home is an investment. Consistent upkeep helps you avoid emergencies, save on utilities, and protect your equity for the long term.

Ready to create a tailored maintenance plan for your home? I can connect you with trusted local service pros and show you how proactive upkeep contributes to your home's market value. Let’s talk about keeping your home in peak condition and protecting one of your most valuable investments.

Sources

1. Finance Buzz

2. Thumbtack

3. Bark

4. Government of Canada

5. Natural Resources Canada

6. FurnacePrices.ca

7. Home Depot

8. CBC

9. 1CleanAir

10. U.S. Department of Energy -

11. NerdWallet

12. Lowes

13. Firefighting in Canada

14. Government of Canada

15. NerdWallet

16. Angi

17. The Spruce

Real Estate Market Update: What Mid-Year Indicators Mean for Your Next Move [July 2025]

July 1st isn’t just Canada Day—it also serves as a pivotal checkpoint for assessing how 2025 has unfolded so far and what might be coming in the months ahead.

Canada’s real estate market remains shaped by economic uncertainty, fluctuating interest rates, and global trade tensions. However, a recent rise in existing home sales suggests a more positive shift may be underway.1

Whether you’re considering buying a home, selling, or simply evaluating your next steps, understanding today’s market is essential. In this comprehensive market update, we examine four key factors influencing today's housing market and provide actionable strategies for navigating these evolving conditions.

MARKET REMAINS SUBDUED, BUT THERE ARE EARLY SIGNS OF RECOVERY

After declining in the first part of the year—primarily due to market uncertainty and an ongoing trade dispute with the U.S.—Canadian home sales rose 3.6% between April and May, marking the first monthly gain in national activity since November 2024, according to the Canadian Real Estate Association (CREA).2,3 This subtle but significant uptick was largely driven by increased sales in Toronto, Calgary, and Ottawa.3

“May 2025 not only saw home sales move higher at the national level for the first time in more than six months, but prices at the national level also stopped falling,” said CREA Senior Economist Shaun Cathcart. “It’s only one month of data … but there is a sense that maybe the expected turnaround in housing activity this year was just delayed for a few months by the initial tariff chaos and uncertainty.”3

What it means for you: While it's too early to declare a full rebound, this shift could signal renewed momentum heading into the summer and fall. Buyers may want to act before prices begin to climb again, while sellers should be prepared for a potentially more competitive market in the months ahead. We can help you assess the right time to make a move.

FIXED MORTGAGE RATES OFFER SOME STABILITY

Heading into the second half of 2025, mortgage rates remain top-of-mind for many Canadians. A growing number are opting for fixed-rate mortgages over variable options, not because they’re dramatically cheaper—but because they offer predictability during an uncertain time.4

“We all hoped that rates would be a lot lower by now, but with Trump in office there’s just too much uncertainty,” notes Victor Tran, a mortgage and real estate expert with RATESDOTCA. “People don’t want to deal with that, and going for a fixed rate could be a safer bet.”4

Economists’ predictions are mixed as to whether the Bank of Canada will cut its overnight rate again before the end of the year. Persistent inflation, along with trade-related economic risks, may continue to limit the scope and speed of any reductions.5

What it means for you: For buyers or homeowners considering refinancing, now is a critical time to speak with a mortgage advisor. Understanding your borrowing power and options can help you act with confidence. We’d be happy to refer you to a trusted mortgage professional in our network.

A RETURN TO BALANCED INVENTORY IN SOME AREAS

After several years of tight inventory conditions, Canada is slowly seeing a more robust supply of homes hit the market—though the story varies by region. There were 201,880 properties listed for sale in May, a 13.2% year-over-year increase, though still about 5% below the long-term average.3

With a national inventory of 4.9 months, Canada’s real estate market is currently balanced. This means there’s no strong tilt toward either buyers or sellers nationally, but significant regional differences remain.3

“If you’re looking to buy or sell a property heading into the second half 2025, you’ll need to understand how national trends are or are not playing out locally, so contact a REALTOR® in your area today,” advises CREA Chair Valérie Paquin.3

What it means for you: Whether you’re house hunting or planning to list your home, local market conditions matter more than ever. Having a knowledgeable agent by your side can help you understand supply and demand in your area—and strategize accordingly.

For buyers, we can help identify hidden gems and guide strong offers. For sellers, we can develop marketing strategies to move your home efficiently, even in a competitive landscape.

HOME PRICES PAUSE—BUT NOT ACROSS THE BOARD

Home prices nationally stabilized in May, with the MLS® Home Price Index down just 0.2% month-over-month—a notable slowdown after three consecutive months of 1% declines. However, prices are still down 3.5% from May 2024, and the national average sale price of $691,299 reflects a 1.8% year-over-year dip.3

However, the story differs among regions. According to the Royal Bank of Canada, high-priced markets like Southern Ontario and parts of British Columbia remain especially soft.6

Elsewhere in the country, price trends appear more stable. Prairie cities such as Edmonton, Saskatoon, and Regina, along with markets in Quebec and Atlantic Canada like Quebec City and St. John’s, have held up relatively well. While not entirely insulated from broader economic uncertainty, these areas have thus far avoided the steeper price corrections seen in the most expensive regions.6

What it means for you: If you're a buyer with flexibility around property type and location, this shifting market could present valuable opportunities—particularly in areas seeing price corrections.

For sellers, understanding local supply and demand is essential, and a tailored strategy may be needed to stand out. We're here to help you make sense of the data and navigate these conditions with confidence.

LET’S MAKE YOUR NEXT MOVE A SMART ONE

While national housing reports can give you a “big picture” outlook, much of real estate is local. And as local market experts, we know what's likely to impact sales and drive home values in your particular neighbourhood.

For buyers, this could be the most favourable environment in years. For sellers, the right strategy, price, and timing are more important than ever. And for homeowners, understanding your property’s value in a shifting market can help with decisions about refinancing, renovating, or investing.

The best decision is an informed one, and that’s where a trusted real estate professional comes in. We have the local insight, negotiation skills, and market knowledge to help you succeed—whether you're buying your first home, selling your third, or simply weighing your next move. Reach out today to start a conversation about your goals and how the current market can work for you.

The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, or tax advice. Consult the appropriate professionals for advice regarding your individual needs.

Sources:

1. RBC Economics

2. Global News

3. Canadian Real Estate Association

4. Canadian Mortgage Professional

5. Yahoo! Finance

6. Royal Bank of Canada

Ready to Buy or Sell a Home? Here Are 5 Key Factors in Choosing the Right Agent [June 2025]

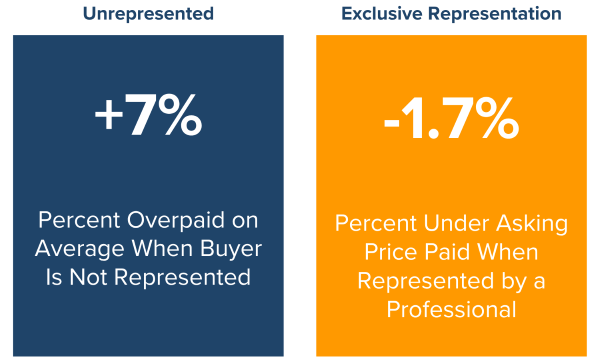

Navigating the real estate market without guidance is like starting an expedition without a map. Whether you're selling your cherished family home or searching for your dream property, having the right real estate agent by your side can make all the difference.

According to a 2024 report from the U.S.-based National Association of Realtors, agent-represented homes sold for nearly 14.5% more than those sold by owners alone.1

But home sellers aren’t the only ones who can benefit. A study by the Consumer Federation of America found that homebuyers can save significantly by working with an agent dedicated to their interests.2

While it’s easy to see the advantages of working with a real estate professional, it can be challenging to find the right representative whose expertise, service, and terms align with your specific needs. This comprehensive guide presents five factors to consider when choosing a real estate agent who can deliver results while streamlining the process.

1. Credentials & Reputation

A well-qualified agent brings more than just enthusiasm; they bring training, experience, and a proven track record.

First, ensure your agent holds a valid licence through your provincial real estate council or board. Canadian real estate agents must complete provincially mandated education, pass licensing exams, and adhere to strict ethical standards, especially if they are members of the Canadian Real Estate Association or a local real estate board.3

Next, inquire about the agent’s continuing education. Real estate designations and certifications indicate additional training and a commitment to excellence in specific areas of real estate.

When it comes to reputation, don’t hesitate to ask for references and check online reviews. Past clients can provide insight into the agent’s communication style, negotiation skills, and ability to manage complex transactions. Prioritize any feedback you receive from trusted family and friends.

Additionally, take time to visit the agent’s website and social media channels to see if they regularly share useful and relevant real estate information, such as market updates, home buying and selling tips, or neighbourhood insights. A well-maintained online presence not only reflects their commitment to staying engaged in the industry but also shows they are a resource for their clients before, during, and after a transaction.

2. Local Market Knowledge